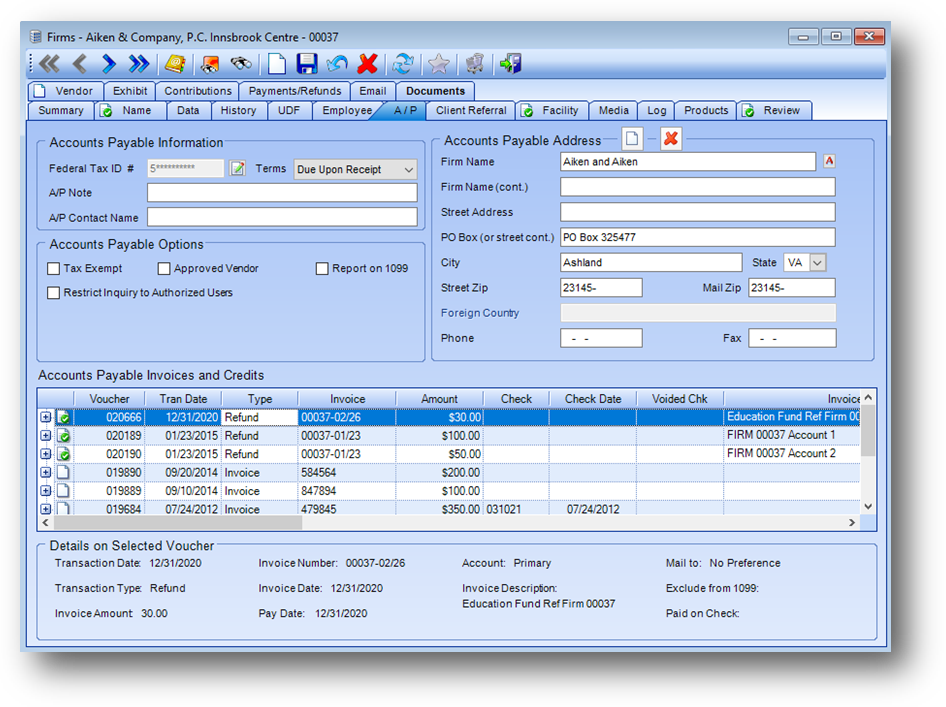

Purpose: The system contains a fully-functional accounts payable module with voucher-approval and check-writing capabilities. Many associations use the A/P module to handle all outgoing checks, even for vendors such as utilities companies that would not normally have any relation to the membership system. Even those associations that do not use the A/P function to its full advantage use it for dues and CPE refunds, CPE leader honorariums, and CPE facility rentals.

The prime advantage of using the system’s built in A/P functionality is that all of the payments can be tied directly back to the related Names and Firms records. This allows one-stop-shopping when looking for pertinent information about an individual or firm. This tab is divided into five sections described below.

Launch Point: This tab can be launched from:

•Firms → File Maintenance →

Example:

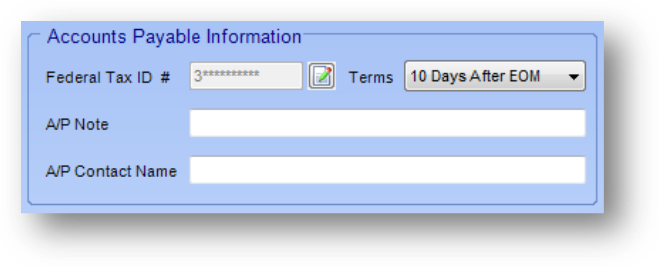

Accounts Payable Information

Federal Tax ID #: The federal tax ID number for the firm. The system uses this information when generating the 1099 forms. Note: A system parameter determines whether the information is stored in an encrypted format for security. If the parameter is set to encrypt, the edit button must be used to add/edit the federal tax id number since the field is disabled. The edit button will decrypt the number and show it in an edit window. Contact Custom Data Systems to have the setting applied.

Terms: The system uses this information to set a default pay-date on any new vouchers. This default can be manually overwritten on any particular voucher, as needed. Allowed values are: “Due upon Receipt”, “10 Days”, “15 Days”, and “30 Days”. Additional values, such as “10 Days after end-of-month” can be added without custom programming, with some restrictions.

A/P Note: Miscellaneous note for this A/P vendor.

A/P Contact Name: The person to contact at the firm regarding A/P items.

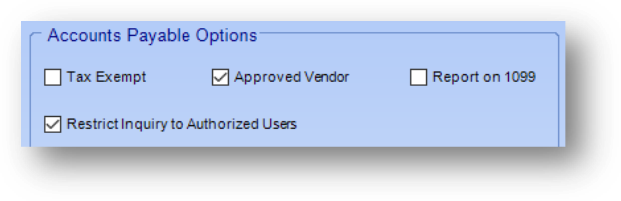

Accounts Payable Options

Tax Exempt: The system uses this in determining whether state and local tax should be applied to this firm in a product sale. Check the box if this firm is exempt from tax.

Approved Vendor: Designates that this firm is a valid vendor or payee for whom A/P vouchers can be created. Tied to the system preference “Filter new vouchers to firms that are approved vendors”. When the system preference is turned on this field controls whether a new A/P voucher can be added for this firm. If the box is checked a new voucher can be added. When this feature is turned off in the system preferences, all firms would be considered eligible.

Report on 1099: The system uses this in determining whether 1099 statements should be sent for this firm.

Restrict Inquiry to Authorized Users: Used to hide A/P voucher information, including A/P voucher documents on the Documents tab, from unauthorized viewers. Rights for editing this field are controlled by the Edit Restrict Inquiry to Authorized Users right in the system security setup, by the system supervisor. Rights for accessing the A/P Voucher information is controlled by the Access to view A/P vouchers for restricted persons/firm right in the system security setup. An example of how this feature might be used would be to hide from the general staff payments to Vendors.

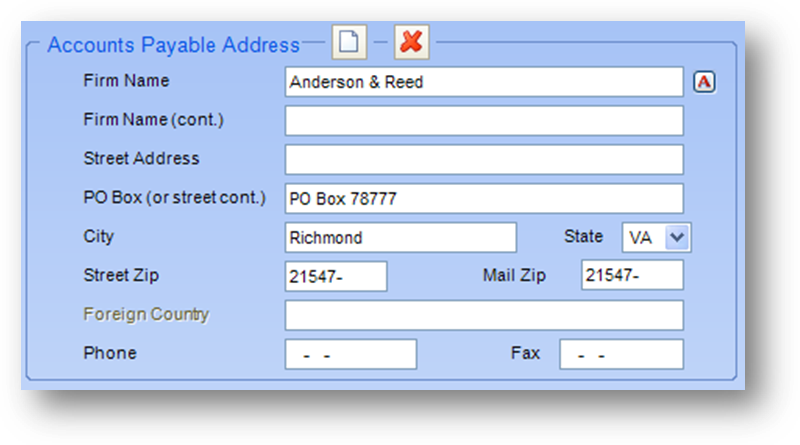

Accounts Payable Address

AP Address: If you wish to use a different address when paying this firm than is found on the Name tab enter the address here. See documentation on Addresses for add/edit functions of this section.

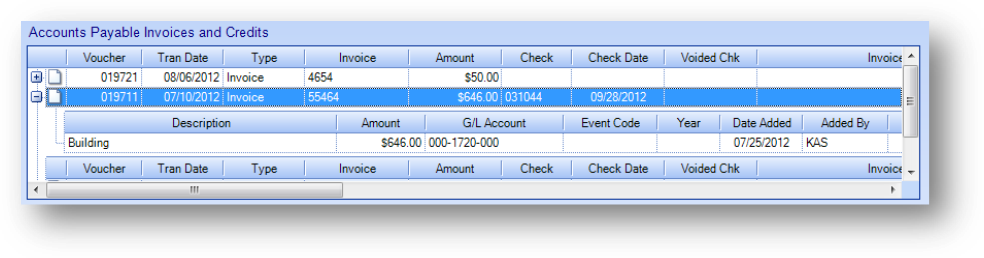

Accounts Payable Invoices and Credits

This grid displays a full history of vouchers and checks written for this firm. To view the line item detail row(s), click on the plus sign to the left of the voucher row.

Note: The icon displayed in the far left of a parent row in the Accounts Payable Invoices and Credits grid relates to the Manage Documents routine.

Note: Uploaded documents can be viewed by right-clicking on the applicable voucher row and selecting View Documents from the context menu.

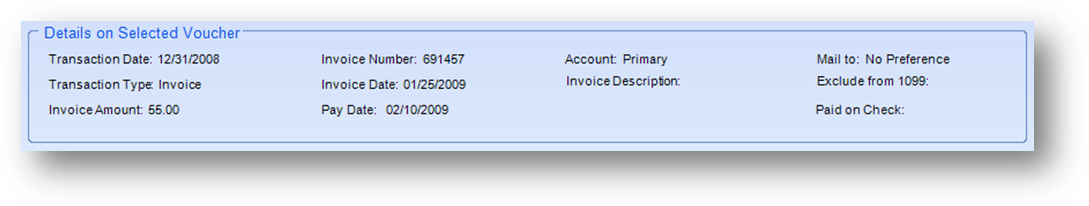

Details on Selected Vouchers

This section displays the details of the highlighted voucher in the Accounts Payable Invoices and Credits grid.

Watch the Firms Accounts Payable tab video: