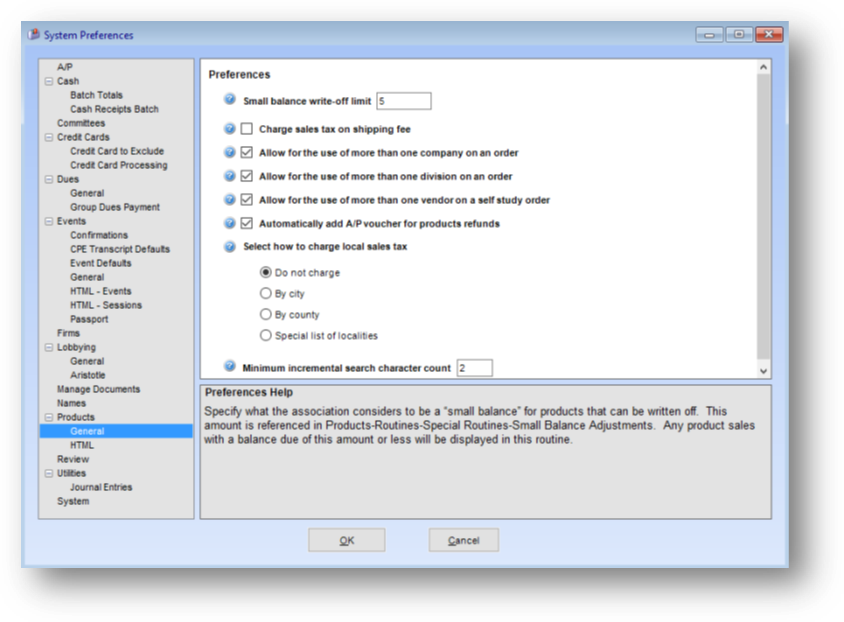

Small balance write-off limit: Specify what the association considers to be a “small balance” for products that can be written off. This amount is referenced in Products-Routines-Special Routines-Small Balance Adjustments. Any product sales with a balance due of this amount or less will be displayed in this routine.

Charge sales tax on shipping fee: If your state requires that sales tax be applied to shipping charges check this box.

Allow for the use of more than one company on an order: Check this box if your association allows a single product sale, with multiple line items, to have a different Company on the Item Information tab in Products file maintenance on the line items.

Allow for the use of more than one division on an order: Check this box if your association allows a single product sale, with multiple line items, to have a different Division on the Item Information tab in Products file maintenance on the line items.

Allow for the use of more than one vendor on a self study order: Check this box if your association allows a single product sale, with multiple self study line items, to have a different Vendor on the Classification and Inventory tab in Products file maintenance on the line items.

Automatically add A/P voucher for products refunds: For associations that use the A/P functions in the system. When checked the system automatically adds a refund voucher, as part of Products-Routines-Special Routines-Refund Credit Balances, if the refund type of check is selected.

Local Sales Tax option: Specify how your state charges local sales tax.

Minimum incremental search character count: Set to the minimum number of characters required before the products incremental search results are displayed. Must be set between 1 and 4. Setting this to 1 may have a detrimental impact on the system performance if you have more then 2,000 records in this module. 2 is the recommended setting.