The system can be configured to charge a fee for sales tax when a registration is entered via AM.NET. Note: Contact your web developer to have functionality added to your website for a sales tax fee on registrations entered via your website.

This CPE Sales Tax functionality has to be turned on in the system by CDS. If you would like to use the CPE Sales Tax functionality, please contact CDS to have it turned on.

Note: There are parameters used by the CPE Sales Tax function that also need to be set up by CDS before the function can work. Please inform CDS if you want the state from the registrants Firm or Home address used in determining if a sales tax fee is applied.

Once the CPE Sales Tax functionality has been turned on in your system, and the parameters have been set, the functionality relies on there being tax rules setup in Manage CPE Tax Rate and a Tax Rule being selected in Events File Maintenance for sales tax fees to be added when a registration is added.

Go to Utilities – Routines – Supervisor Functions - Manage CPE Tax Rate to add rules for state(s) to charge a CPE sales tax fee for.

On events where a sales tax is applicable, go to the Data (cont.) tab in Events file maintenance and select the appropriate Tax Rule.

Then when you enter a registration, via AM.NET, in an event with a Tax Rule and for a registrant whose state has that tax rule listed in Manage CPE Tax Rate, a sales tax fee will be applied.

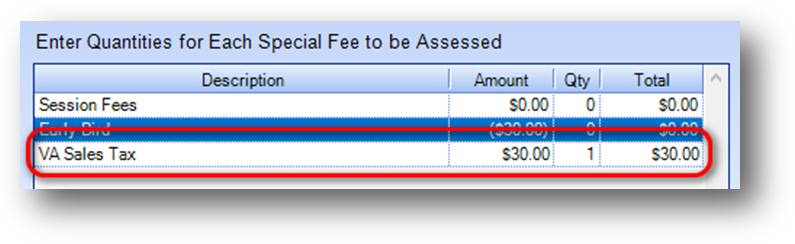

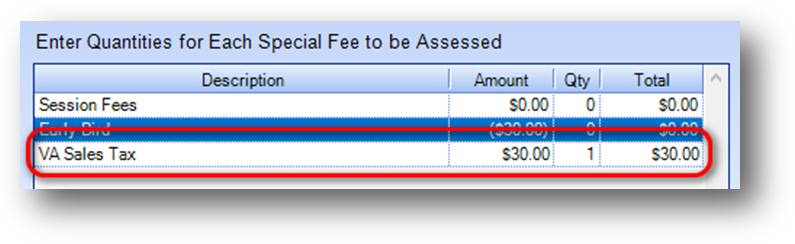

In Event Registration, for registrants where a sales tax would apply, will see “XX Sales Tax” fee listed in the Enter Quantities for Each Special Fee to be Assessed grid with Qty set to 1 and Amount calculated by multiplying the Tax Rate and the net of other selected fees. With Qty set to 1 the special fee is also show in Selected Fees grid. The sales tax fee amount is updated as fees applied are changed.

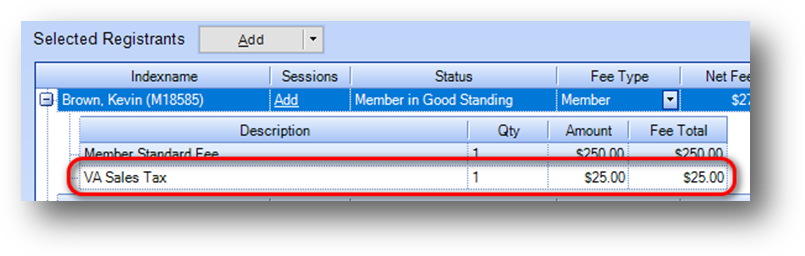

In Group Registration (with fees), for registrants where a sales tax would apply will see “XX Sales Tax” fee listed in the child rows. The sales tax fee amount is updated as fees applied are changed.