When you set the system up to utilize job costing transactions associated with a job cost general ledger (G/L) account are linked to a specific event.

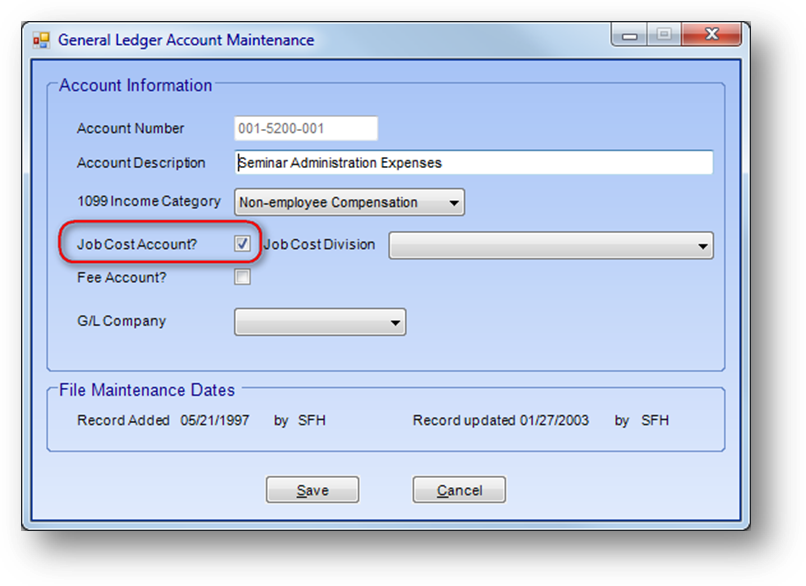

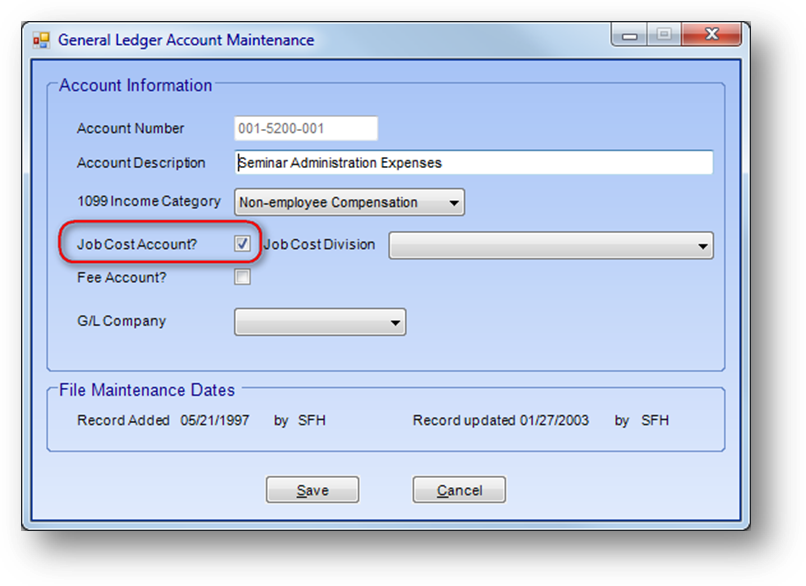

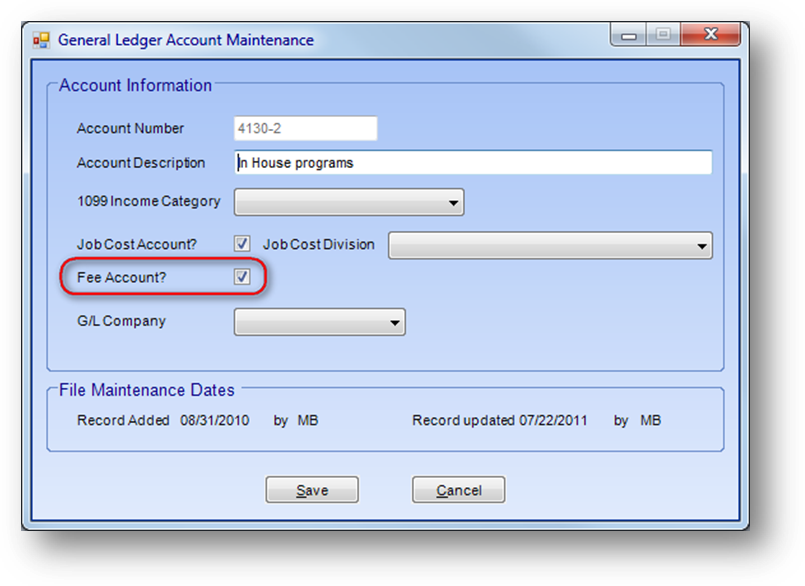

Any G/L account to be job costed, usually expense accounts, need to be flagged as a job cost account in Utilities – Routines – Accounting Setup - General Ledger Account Maintenance.

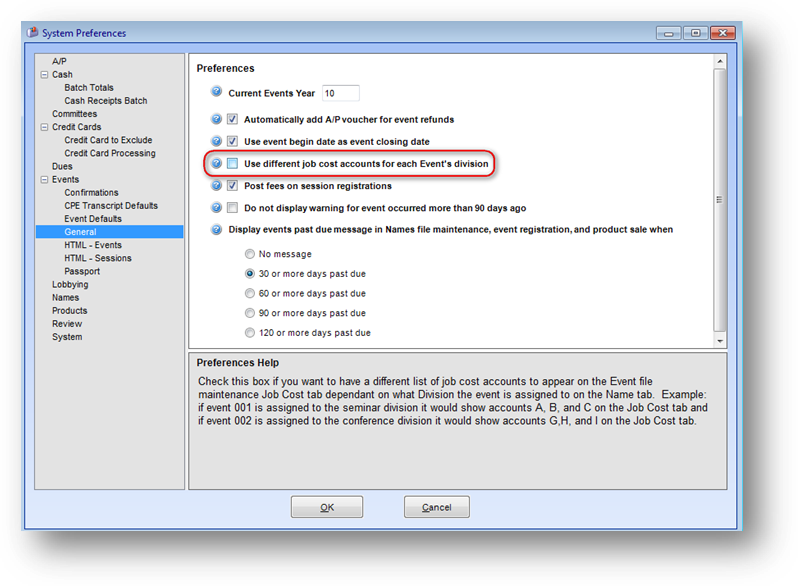

If you have job cost accounts that specifically relate to only one event division you can use job cost divisions. First go to File - System Preferences. Under Events – General turn on Use Different Job Cost Account for Each Event’s Division.

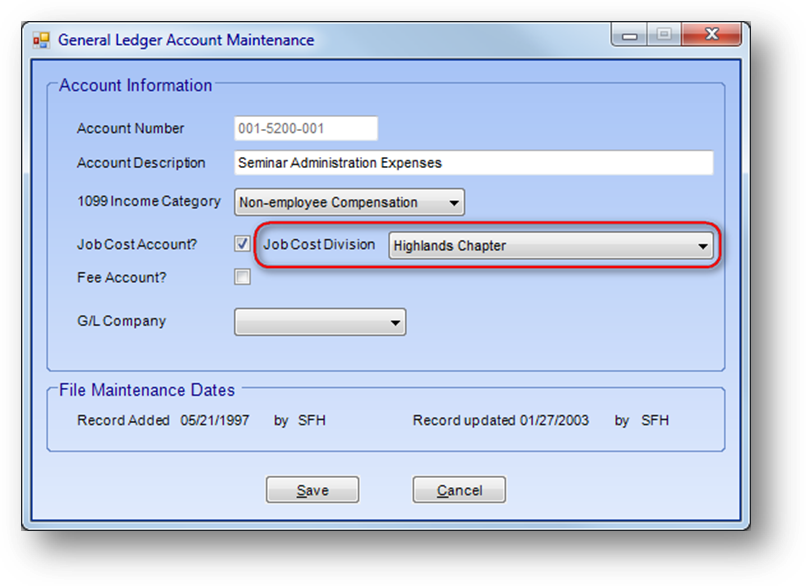

Then, in addition to setting the G/L account as a job cost account in General Ledger Account Maintenance, select the event division the G/L account would be valid for in the Job Cost Division drop down list.

Note: If a G/L account is used in more than one division leave Job Cost Division blank.

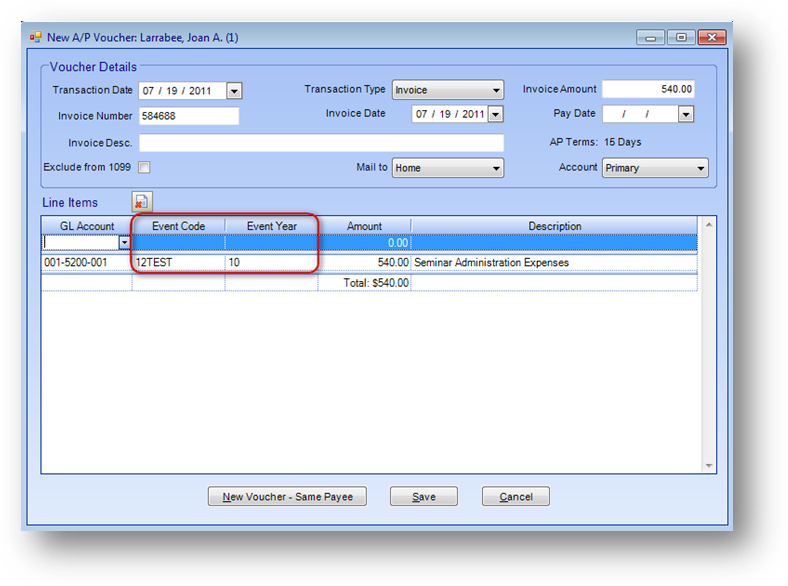

When using Add A/P Voucher, Edit A/P Voucher, or Miscellaneous Cash Receipts and a G/L account that is flagged as a job cost account is entered, you will be prompted to select an event. In the event search screen locate the specific event this line item relates to. If the G/L account is set up with a job cost division, only events with a matching division or a blank division, will be allowed to be selected.

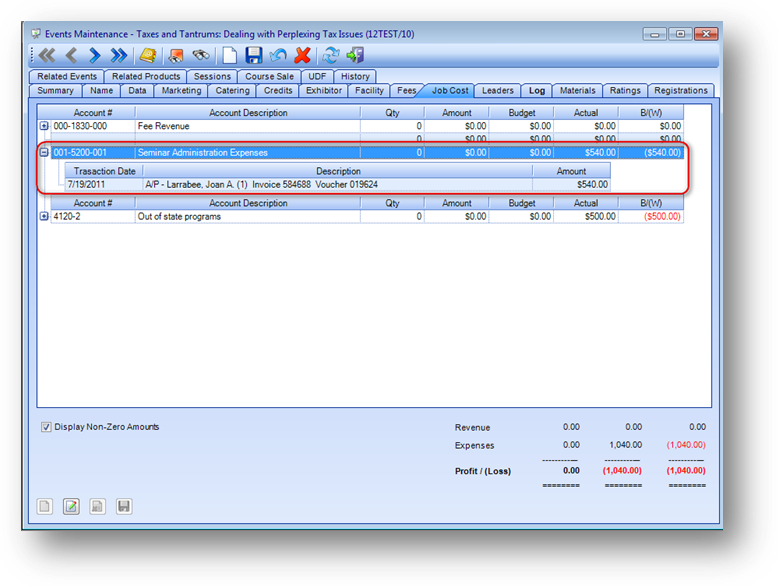

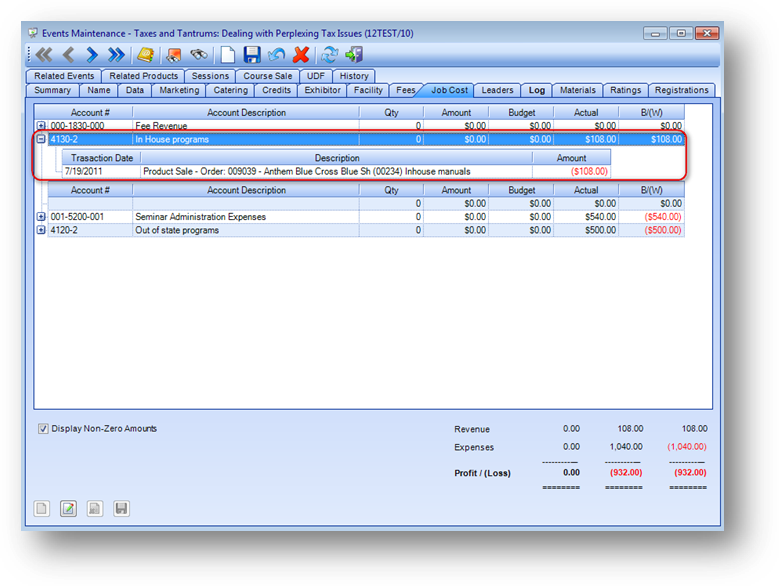

In Events file maintenance on the Job Cost tab information from A/P vouchers and miscellaneous cash receipts using a job cost account linked to that specific event will be displayed.

Note: Job cost information can also be seen by running Events – Reports – Financial - Job Cost Details/Summary. This report has several format options.

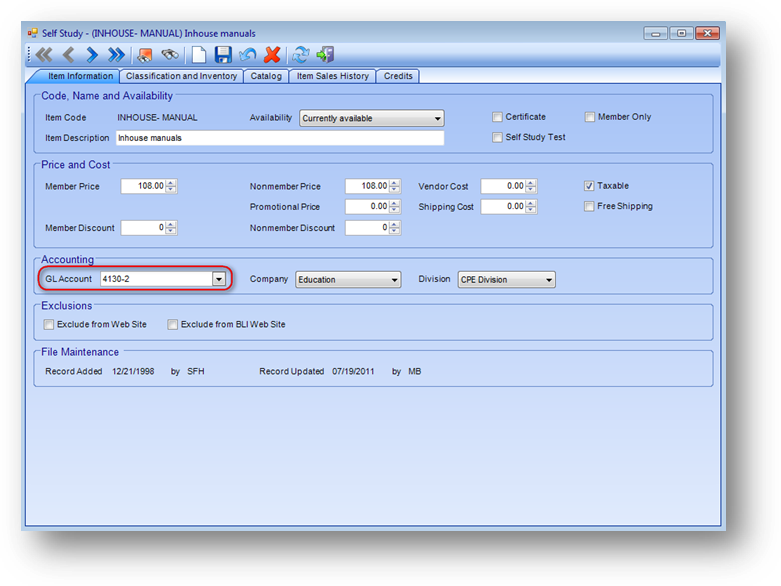

Job costing can also be used to associate the income from a product sale to a specific event. In Utilities – Routines – Accounting Setup - General Ledger Account Maintenance set the product income G/L account as a job cost account.

Then in Products file maintenance on the Item Information tab set GL Account to that product income G/L account.

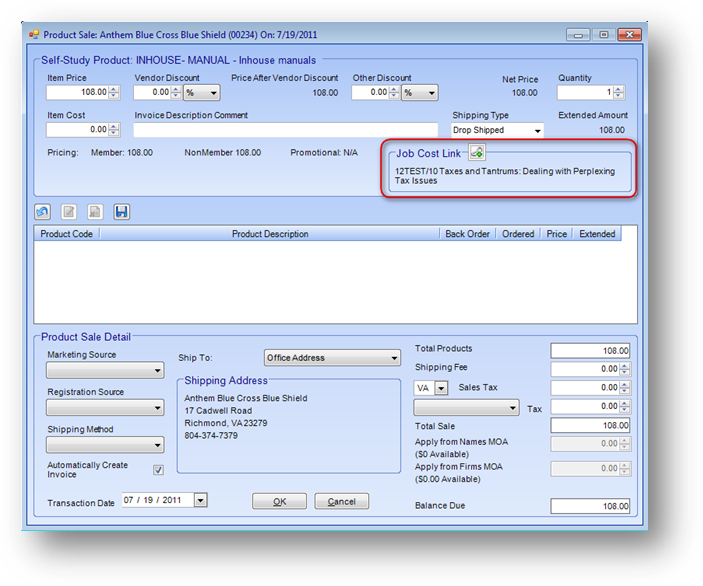

When entering a Product Sale, if the product selected has a job costed income account, there will be a Job Cost Link displayed in the top section of the window. Click on the Add Link icon and select the event to associate the income of this line item to. The same rules apply if you are using job cost divisions.

Again the Job Cost tab in Events file maintenance will display the information from the product sale that used the job cost account linked to that specific event. These amounts show as a positive amount. Job cost transactions coming from a product sale are shown along with expenses for the event entered via an A/P voucher. Since they are actually income to the event they are shown as a positive expense.

If, in General Ledger Account Maintenance, the G/L account is also set as a Fee Account.

Money associated with a product sale can be shown with fee revenue (income) on Events file maintenance Job Cost tab.